Global trade has become increasingly complex, and sudden shifts in tariffs and trade regulations have become more common, impacting manufacturers the most. Even a single policy change, such as the U.S. imposing a 25% tariff on imported steel, can disrupt the supply chain and increase raw material costs, forcing companies to rework pricing strategies.

If you are also worried about navigating tariff challenges, this blog is for you. It is a comprehensive guide for manufacturers that provides extensive knowledge on tariffs, their challenges, and how ERP helps you navigate these challenges.

Table of Contents

Understanding tariffs and trade codes

A tariff is a type of tax or duty imposed by the government on imported goods, which is ultimately passed on to the consumer. For instance, recently, the U.S. imposed tariffs on countries such as India (50%), China (100%), and Brazil (50%). These increased taxes have raised the cost of goods imported from these countries, increasing import costs for businesses and consumers and lowering the sales opportunities for businesses of countries on which tariffs are imposed.

The two types of tariffs:

- Specific tariff – It is a fixed fee that is imposed based on the type of item.

- Ad valorem – It is the type of tariff that is imposed based on the value of the item.

Trade codes

Before understanding how you can manage tariffs within your ERP system, you need to know about the product classification codes that customs authorities use worldwide. These codes specify how imports and taxes should be calculated, as well as how trade regulations should be applied to ensure international compliance. The two types of trade codes:

HS Code (Harmonized System Code)

The HS Code is developed by the World Customs Organization (WCO) and is recognized globally. These codes segment products using a six-digit numerical system, and each code corresponds to a specific product type. Using this common classification streamlines customs procedures and provides consistency across borders that is essential for international trade. Errors in HS Code classification can lead to delivery delays, penalties, or unexpected taxes.

HTS Code (Harmonized Tariff Schedule Code)

Unlike the HS Code, which is universal, the HTS Code is specific to the United States. The HTS Code is derived from the HS Code and contains four additional digits. The first six digits are the same as in the HS Code, and the last four digits are unique to the U.S. trade law, which determines the specific tax rates and tariff treatments applied to imported goods.

Why are these codes important in ERP?

Within ERP (Enterprise Resource Planning) systems, HS and HTS Codes are important data points that enable accurate reporting, regulatory compliance, and operational efficiency. If you have stored the right codes, an ERP system can:

- Auto-calculate applicable tariffs and duties – Applies accurate rates instantly during imports/exports, avoiding manual errors.

- Ensure customs compliance – Can generate trade documents with accurate HS and HTS codes to reduce clearance delays and penalties.

- Streamline cross-border trade – Standardize product classification for faster processing across multiple countries.

- Enhance cost visibility – Gives precise insights into landed costs by factoring in duties, tariffs, and taxes.

- Simplify regulatory reporting – Quickly compile reports required by customs authorities or trade regulators.

- Improve supply chain agility – Enables fast decision-making when tariffs or trade rules change by reclassifying products.

- Support accurate pricing – It can auto-update product pricing, reflecting the impact of duties and tariffs on raw material or finished goods.

- Integrate with logistics workflows – Ensures that your shipping and freight documentation carries consistent and accurate codes.

Challenges manufacturers face due to tariffs and trade shifts.

The US has imposed a 25% tariff on steel and aluminium. Many manufacturers, like metal fabricators and job shops, rely on these elements to fabricate their products. However, as these metals are imported from China and other Asian countries, the increased duty taxes on them have made the US less competitive. With this, US manufacturers face a dilemma of whether to pass these additional costs to customers or absorb them, downstreaming their finances.

Manual price updation in bulk

Frequent shifts in trade tariffs force manufacturers to update prices regularly to maintain profitability. If this process is manual, it becomes time-consuming and prone to errors, increasing the risk of misquotations, customer disputes, and revenue leakage. Automated systems are frequently required to handle real-time pricing changes efficiently.

Example: A fabrication company has dozens of active contracts and quotes out in the market. As tariffs fluctuate and raw material costs rise, the sales team manually updates spreadsheets and reissues quotes. This not only takes up administrative time but also leads to errors, such as underpricing a large order, which results in financial losses.

Keeping up with changing regulations

Tariff regulations and tariffs are constantly changing. They shift as a result of political decisions, trade negotiations, or global economic changes. Staying compliant requires manufacturers to adapt immediately when new tariffs or customs codes are introduced. Missing these updates can lead to shipment delays, penalties, and customer loss.

Example: A Canadian metal fabrication company exports steel sheets to the U.S. When the U.S. enforces a 25% tariff, businesses immediately reclassify products with updated HS/HTS codes in their ERP systems and adjust prices accordingly. If they do not update the codes properly, customs may hold shipments at the border due to incorrect documentation, leading to delays.

The tariff costs can go much deeper, like:

- Tracking tariff rules, hiring extra help, or pulling focus from main tasks.

- Shifting to new suppliers is time-consuming and causes delays, increased costs, and complications.

- You need to buy more than they need to avoid price spikes or shortages.

- Switching to local materials to combat tariffs necessitates redesigning your product, which takes time, resources, and money.

- Price spikes due to tariffs make your product less appealing in the global market.

- Increasing prices to tackle higher tariffs risks losing customers or getting priced out of the market.

How does ERP software handle tariffs?

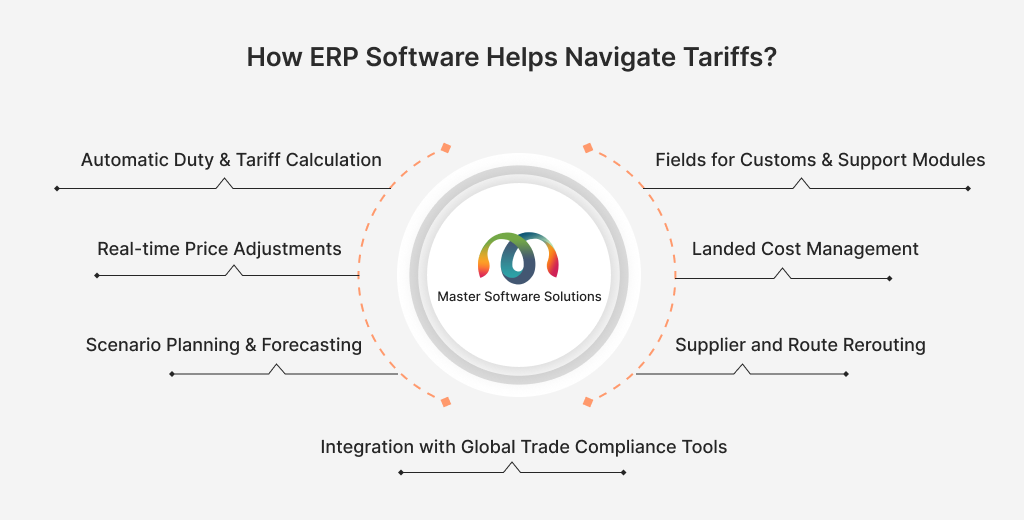

Manual business management makes it challenging to manage the impact of tariffs. Implementing an ERP system provides a centralized platform that offers features to manage and mitigate these risks. Here is how ERP software helps navigate tariffs:

Automatic duty & tariff calculation

Tariffs can directly impact the landing cost, your pricing strategies, and compliance requirements. The ERP system associates tariff information with product records and stores it within the product master data. HS/HTS codes with trade databases are integrated with ERP to automatically apply the correct duty or tariff percentage, saving time and preventing manual errors.

Fields for customs & support extension/modules

It can store information in fields like HS/HTS codes, country of origin, and customs classifications. Some ERP systems offer fields for customs or support extensions/modules to store additional compliance data, ensuring that each product contains accurate classification and carries the same information throughout the supply chain. This ensures proper reporting and duty calculations.

Real-time price adjustments

As tariffs change, the system automatically updates landed costs, allowing you to revise customer quotes, sales orders, and contracts.

Landed cost management

The system also tracks freight, insurance, and handling charges, providing manufacturers with a true cost of goods, allowing them to adjust pricing while maintaining profits.

Scenario planning & forecasting

You can also use cost-impact analysis to determine whether to change suppliers, renegotiate contracts, or adjust pricing.

Supplier and route rerouting

ERP systems can flag suppliers or regions with lower tariffs, allowing procurement teams to reroute orders and support alternative sourcing strategies.

Integration with global trade compliance tools

Some advanced ERP systems connect to government or trade compliance databases, automatically updating tariff rates and regulatory changes in real-time.

Conclusion

Tariffs and shifting trade have become an ongoing reality for manufacturers, particularly in industries such as metal fabrication, where supply chains cross borders. An ERP provides the tools to keep up with tariff challenges and turn them into opportunities. Investing in an ERP software solution helps businesses become resilient in an unpredictable global landscape.

Master Software Solutions is an IT service provider that offers ERP implementation services for various industries, including manufacturing, beverage & food, retail, logistics, etc. We work with Odoo and Microsoft Dynamics 365 to offer tailored solutions to cater to your business needs.